Auto insurance coverage policies can consist of various types of insurance coverage that serve differing functions, as well as you can choose to be covered by some or all of them. State regulation normally identifies whether or not a deductible is called for.

This covers you if your lorry rams another vehicle or object and you require to spend for repair work. Accident deductibles are conventional yet vary by insurance provider. If your automobile is harmed by an occasion such as fire, a dropping things striking your windscreen or criminal damage, you'll submit an extensive insurance coverage insurance policy claim.

If the various other driver in an accident is at fault yet they aren't guaranteed or don't have enough coverage to spend for your residential property damage, this kind of protection will pertain to the rescue. Deductibles are sometimes needed for this protection, however not always, as well as demands vary by state. While your car insurance policy deductible can vary considerably relying on many factors, including just how much you wish to pay, automobile insurance policy deductibles generally vary from $100 to $2,500.

When picking an insurance deductible, you'll require to think about several variables, including your budget. Spend some time calculating exactly how much you can afford to pay for a deductible and also just how much you'll save money on your regular monthly costs by going with a greater one. Ask yourself these questions when picking an insurance deductible amount.

affordable auto insurance money cheap auto insurance cheap

affordable auto insurance money cheap auto insurance cheap

You need this buffer in case the worst takes place, however if you're a risk-free driver or do not drive usually, making use of an emergency fund to cover any kind of mishaps might be an alternative. This is a vital concern when considering what insurance deductible to pick. If you get in a crash, can you pay for the deductible or would certainly you battle to pay it? Tackling a high deductible might not make much feeling if it represents a huge portion of the vehicle's worth (vehicle insurance).

The smart Trick of What Is Comprehensive Insurance? - The Hartford That Nobody is Talking About

Keep in mind, your cars and truck's real money worth takes into consideration the price of your auto when you bought it, in addition to the age and condition it remains in at the time of the accident. Just how do I pick a deductible? It is very important to pick an insurance deductible that you fits your economic scenario. risks.

On the other hand, if you do not have sufficient money to cover your deductible in the event that there's protected damage to your vehicle, you may have trouble getting your vehicle repaired. To select the correct amount, think of just how much you might pay out-of-pocket to have your car repaired without experiencing a great deal of financial stress and anxiety in your life. trucks.

along with your cost savings and also charge account. You have a collision case that triggers $6,000 in damage to your cars and truck, which has a real cash money value of $20,000. When you bought your crash insurance coverage, you picked a $500. 00 deductible (accident). This indicates you are accountable for paying the initial $500.

cheap auto insurance car insurance car insurance liability

cheap auto insurance car insurance car insurance liability

Have questions about your existing deductible or readjusting it? Give us a phone call at or come by a Straight Car Insurance policy place near you (suvs).

Allow's claim you simply entered an accident as well as your cars and truck requires $4,000 out of commission, however your insurance will only cover $3,000. If you're puzzled, comprehending your automobile insurance policy deductible could be the response. In this article, we'll discuss what a cars and truck insurance deductible actually is, when you need to pay it, and also whether you ought to pick a high or reduced one.

What Is An Insurance Deductible? Go here - Ramseysolutions.com Can Be Fun For Everyone

You don't actually pay an insurance deductible to the insurance coverage company you pay it to the repair work store when they fix your auto - cheapest. If you have a $500 insurance deductible, you need to pay that quantity before the insurance business pays the remaining $1,500.

Your car insurance deductible doesn't function like your health and wellness insurance policy deductible. With health insurance coverage, you have an insurance deductible that gets reset every year.

cheaper car car insurance affordable auto insurance suvs

cheaper car car insurance affordable auto insurance suvs

When the new year rolls around, everything begin again. With cars and truck insurance policy, you pay your insurance deductible every time you submit an insurance claim. Allow's claim you obtained right into a crash as well as submitted a crash insurance claim. On your way to the repair shop, a freak hailstorm tornado adds even more damage to your auto - accident.

There is no restriction to how many times you pay your insurance deductible in a year - affordable auto insurance. If you file 5 various accident insurance claims in one year, you'll pay your insurance deductible five times. Just How Do Vehicle Insurance Coverage Deductibles Job? When you start an auto insurance plan, you get to choose the protection amounts.

If you live in an area with constant bad weather, you could want to choose a reduced extensive insurance deductible to restrict what you pay out of pocket. At the same time, you can keep your accident insurance deductible greater to balance out your car insurance coverage premium. Sorts Of Insurance Insurance Coverages With Deductibles Right here are the typical sorts of cars and truck insurance policy, with details on what they cover as well as whether they require an insurance deductible or not.

Some Known Factual Statements About Is Car Insurance Tax Deductible? - H&r Block

Because instance, your vehicle insurance coverage costs would certainly cost even more to counter the $0 vehicle insurance coverage deductible. When Do You Pay An Auto Insurance Policy Deductible? Below are the primary situations in which you 'd be in charge of paying a deductible: If you trigger a car accident and your vehicle requires repair work, you'll pay your insurance deductible on your accident coverage. auto insurance.

cheapest vehicle insurance cheaper auto insurance vehicle insurance

cheapest vehicle insurance cheaper auto insurance vehicle insurance

How To Pick A Cars And Truck Insurance Coverage Deductible Since you know what a cars and truck insurance deductible is, it is essential to pick the right deductible for your scenario. You should select a high auto insurance coverage deductible if you desire to decrease your monthly costs as well as if you have the ability to pay it.

If you don't have any cost savings, it's not a clever suggestion to have a high insurance deductible. You may be the very best vehicle driver in the globe, yet you still share the roadway with poor drivers and also uninsured drivers. According to the Insurance Coverage Information Institute, concerning 6 percent of motorists that had accident insurance coverage filed a case in 2018.

You can constantly pick a lower deductible while you save up an emergency fund and after that elevate the insurance deductible later. You ought to select a reduced cars and truck insurance coverage deductible if you do not have the capability to pay a high one, or if you wish to safeguard your out-of-pocket prices. A low deductible might be an excellent suggestion if you live in a stuffed location where you have a higher possibility of experiencing a crash.

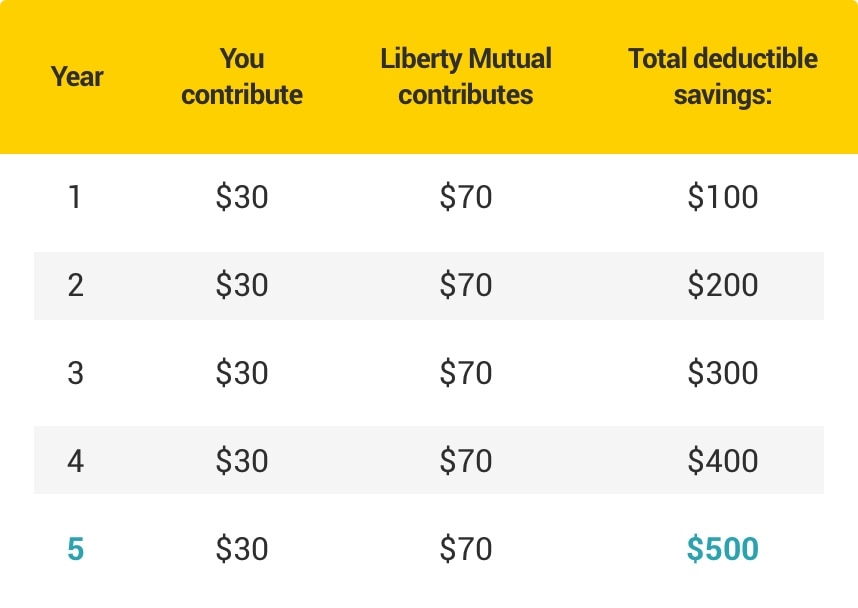

Some programs will reset your deductible to the full amount after you make a case, and others will certainly reset it to a smaller amount. After 5 years, you would have paid an added $100 or even more to your insurance firm.

Not known Incorrect Statements About What Is Car Insurance Deductible? How Does It Works - Way

What Takes place If You Can't Pay Your Deductible? When paying out an insurance claim, your insurer will certainly usually compose you a look for the amount it's responsible for covering. If you are unable to pay the rest of your prices for the insurance deductible, you may have some alternatives. Below are some steps you can take if you can't afford to pay your insurance deductible: Maybe worthwhile to speak with your mechanic about settlement options after a crash. automobile.

dui cheapest car insurance car insurance

dui cheapest car insurance car insurance

Understanding when to change your insurance deductible and also when to go shopping around for a brand-new vehicle insurance policy company with budget friendly rates is the best means to avoid high expenditures in the future (auto). Our Recommendations For Auto Insurance Policy Searching for automobile insurance doesn't have to be challenging. Simply ensure to get quotes from numerous companies, so you can contrast rates.

If you've currently experienced a case, you've most likely found out just how your deductible jobs initial hand. For those who have not, it can create complication about simply what an insurance deductible is as well as who pays for it. insurance. What a deductible is An insurance deductible is the amount of cash you (the called insured on the plan) pays of pocket for the price of damages prior to the insurance provider pays.

Your insurer will pay the staying balance of $500 to the garage. CIRCUMSTANCE 2: In this circumstance, suppose you experience a covered loss with overall damage to your covered car totaling $500. Since you have picked a $500 insurance deductible, you will certainly be in charge of the expenditures. You must not usually anticipate to receive any kind of repayment from your insurer in this situation.

While the quantity of your deductible can raise or lower your premium, insurance deductible and premium are 2 various points. The called insured on the plan is responsible for paying the deductible quantity.

About Car Insurance Deductible: What Is It And How Does It Work?

This implies that also if a person else was driving your cars and truck and also entered into a crash, your insurance firm would take care of the claim and you would be in charge of your plan deductible. It's not the like a wellness insurance coverage deductible. car insured. Deductibles for medical insurance policies typically cover an entire twelve month, meaning you would just pay up for your insurance deductible (i.

However, an auto insurance policy deductible uses "per incident." This means you are in charge of your full insurance deductible amount each time you endure a covered loss. As with all things insurance policy, it's best to discuss deductibles and exactly how they use in your scenario with a neighborhood independent insurance policy representative. Your neighborhood independent representative has the knowledge and also experience to respond to frequently asked questions about deductibles and compute price savings for you relying on the deducible amount you select.

When it concerns auto insurance coverage, an insurance deductible is the quantity you would certainly need to pay of pocket after a protected loss before your insurance policy coverage starts. Automobile insurance coverage deductibles work differently than clinical insurance policy deductibles with vehicle insurance coverage, not all kinds of insurance coverage call for a deductible. Responsibility insurance doesn't require a deductible, yet detailed as well as collision coverage generally do.

When you're adding that coverage to your vehicle insurance coverage, you'll generally have the possibility to make a decision where you want to establish the deductible. insure. Generally, the greater you establish your deductible, the reduced your month-to-month insurance policy premiums will be but you do not intend to set it so high that you would not be able to really pay that amount if needed.

What does a vehicle insurance policy deductible mean? A deductible is the quantity of money you have to pay out of pocket before your automobile insurance will certainly cover the remainder - low-cost auto insurance. For instance, if you backed your cars and truck into an utility pole, your collision insurance coverage would pay for the price of the damage.

Car Insurance Deductibles And Liability Limits Things To Know Before You Get This

If the complete price of repair work comes to $1800, your insurance coverage will only pay for $1300 (car insurance). You can discover your deductible amounts is noted on your affirmations page. Needing to pay an insurance deductible means you can do a sort of cost-benefit analysis prior to you make a claim with your insurance firm.

What kind of insurance coverage needs an insurance deductible?, which covers the prices if you damage a person's residential or commercial property or wound somebody with your vehicle, never needs an insurance deductible., as well as where you establish your insurance deductible will have an affect on your month-to-month insurance premium.