Often Asked Concerns (Frequently asked questions) For how long will insurance policy spend for a rental auto after a failure? The size of time you can rent out an automobile depends upon your insurance protection. You can usually set the quantities and limitations of rental car insurance coverage when you initially established up your policy or make any kind of changes to it.

That is why it is crucial that you call the shop to release the lorry. If the automobile is at a house, COPART will call initial to make setups as well as after that will typically choose up the automobile within 2 to 3 business days.

cheap insurance low-cost auto insurance affordable car insurance

cheap insurance low-cost auto insurance affordable car insurance

They will certainly pick it up and also tow it to one of its whole lots (cheapest auto insurance). (whole lots are in Mendon, Billerica as well as West Warren) What occurs following? Once the car gets to COPART, our appraiser will certainly complete his report and also onward it to us. We will call you when we have actually gotten to the value of your lorry as well as clarify the settlement procedure to you.

When we obtain the completed settlement papers and also title, we will issue our settlement. Suppose I wish to keep my car? Under the terms as well as problems of your policy, we have the right to take the car in negotiation of an overall loss. Sometimes, you may be enabled to maintain your vehicle nonetheless Safety makes that choice on a case-by-case basis after reviewing the insurance claim.

Some states additionally set what's called a total-loss threshold, meaning an established number at which the vehicle have to be stated a failure (so your insurance provider might be needed to state your auto as totaled due to state legislations). For example, Maryland has a total-loss threshold of 75%, so if fixing a damaged automobile would cost even more than 75% of the cars and truck's worth, it's a failure (insured car).

Negotiate with your insurer, If you're saying that your vehicle was worth more than what your insurer made a decision, you'll require proof, like current images of your vehicle, evidence that it was properly maintained and also data concerning what rate cars of the very same make as well as model cost in your area.

The 5-Second Trick For Can An Insurance Company Force You To Total Your Car ... - Insurify

Get an independent appraisal, You may wish to get your vehicle individually evaluated through a fixing store, and afterwards present that evaluation to your insurer. The independent assessment may help you confirm that your automobile is worth greater than what your insurer is using, and they might up the negotiation deal as a result (cheap auto insurance).

Hire a legal representative, You always have the choice of employing an attorney as well as taking your insurer to court, although prior to you make a decision to take that action you need to consider just how much you agree to pay to challenge your insurer's assessment of the automobile's damages, considering that even simply seeking advice from a legal representative can set you back cash. dui.

In some instances, you can select to keep your auto and also try to fix it yourself, although it will certainly still have a salvage title, indicating you won't be able to drive or guarantee it unless the title is rebuilt. If you elect to maintain salvage, i (vehicle insurance). e. pick to keep your car after it's been regarded a total loss, you'll still be paid out the auto's ACV, yet your insurance provider will certainly subtract both the deductible and the vehicle's salvage cost.

One factor you might wish to maintain a completed auto is if you're wanting to get a brand-new one. Some dealerships will enable you to sell your amounted to cars and truck (however it depends upon the amount of damage to your automobile and also the dealer's own policies). You may want to think about hiring an evaluator to ensure the car dealership is supplying you the ideal amount for your completed car.

Once a cars and truck has a salvage title, you need to have it fixed as well as inspected by the state before the title is declared rebuilt. And even after that, the majority of insurance companies will certainly not insure a rebuilt title auto, so it's ideal to take into consideration all these aspects prior to you determine to take your totaled cars and truck house - trucks.

In Alabama, as an example, a cars and truck is thought about a failure if the damage is above 75% of the auto's value. Insurer need to follow state guidelines when it pertains to proclaiming an overall loss, yet they might also do so according to their own policies. What happens if you amount to a rented auto? If you complete a rented auto, you'll have to complete making those lease repayments even if the cars and truck was amounted to.

9 Easy Facts About What Happens When An Insurance Company Totals A Car Described

car insurance car insurance cheap insurance cheap auto insurance

car insurance car insurance cheap insurance cheap auto insurance

Hop in the driver's seat and distort up as we describe what it means when your cars and truck is completed, whether your insurance company will certainly cover a totaled car and even more (insured car). What Does It Mean When Your Automobile Is Totaled? A conventional vehicle insurance policy generally will not pay to fix your car if it's been amounted to.

It differs from another term you may have heard regarding auto insurance: substitute price value. Substitute cost refers to what it would certainly cost to acquire a new auto similar to one that's been amounted to. Check out this site Not all auto insurance coverage offer substitute price as an alternative. prices. Keep in mind that your car insurance coverage costs will certainly be greater if you opt for replacement price value coverage rather than actual cash money value insurance coverage.

When you have a vehicle financing or lease, those two sorts of insurance coverage typically are called for. They aren't legal demands on an auto you have actually settled, howeverthe decision to carry detailed or collision coverage depends on you. Without coverage past the obligation insurance coverage that's called for in nearly every state, you might have to pay of pocket to change your completed auto (particularly if you're at fault in the collision) (liability).

Crash insurance policy uses when your automobile is damaged throughout a collision with one more auto, an object or home. In many cases, an insurance firm might not cover an insurance claim when your vehicle is a failure. Right here are 5 possible factors for your case being denied: You do not have the appropriate coverage, such as thorough or crash.

You were driving while intoxicated. You took too lengthy to report the damage to your insurance policy company. You filed a deceptive claim. Take note that each insurer makes use of various criteria for proclaiming that a cars and truck is a total loss. Nevertheless, an auto that's amounted to by one insurance firm probably would be totaled by another.

If you assume your cars and truck is worth greater than the insurance provider thinks it is, you can try to negotiate a greater payment (cheap car). After your case is authorized, the insurance firm normally presumes possession of the completed auto, which might then be sold for scrap or components. If you desire to maintain your amounted to automobile (which's allowed where you live), the insurance provider will subtract the salvage worth from your insurance claim payout.

The Definitive Guide for How To Negotiate With A Car Insurance Company After A Total ...

Credit rating are based exclusively on the details in your debt record as well as do not include things like your driving record or previous insurance coverage claims. To make sure your credit history stays unscathed, work carefully with your insurance provider as well as your loan provider to make certain the finance covering the vehicle is effectively paid off and also closed.

cheaper insurance companies car insurance cheaper cars

cheaper insurance companies car insurance cheaper cars

While a crash won't hurt your credit rating, it can influence your automobile insurance policy premium, also if your car is totaled after an accident. You could be able to prevent this if you qualify for crash mercy insurance coverage, but that advantage isn't offered in every state or from every insurance company. affordable car insurance.

It should not influence your credit history as long as your auto car loan is paid off one way or one more. Job carefully with your insurance provider as well as your lender, and also stay on top of your credit score. Obtain a cost-free duplicate of your debt report from all three credit rating bureaus at Annual, Credit, Record.

cheap car credit insurance accident

cheap car credit insurance accident

The cash we make aids us provide you accessibility to cost-free credit report and reports and also aids us develop our various other terrific tools and also academic products. Compensation might factor into exactly how and where items show up on our system (as well as in what order). Because we typically make cash when you find an offer you like and get, we attempt to show you offers we assume are a good match for you.

If your lorry is totaled, one of your first questions is most likely how you'll get a brand-new one and also whether insurance will certainly cover the loss. While the response differs from one situation to an additional, something is clear: A strong vehicle insurance coverage can assist obtain you back when driving while securing your financial resources.

Paying also a lot for cars and truck insurance policy? There are crashes, which occur when your auto strikes another car or item, like a deer or also a tree.

8 Simple Techniques For Understand Your Options For A Totaled Car - Investopedia

No matter just how your vehicle is damaged, you'll require to submit a case with your vehicle insurer if you're wanting to get the loss covered - cars. Your insurance company will certainly send out an insurer who will evaluate your automobile's damage and also approximate the cost to repair it. A vehicle is taken into consideration totaled if the cost to fix it is estimated to be even more than its current value.

Some states, such as Alabama and also Kansas, might only call for that the damages equates to 75% of the lorry's worth in order to be proclaimed a complete loss. If you live in one of these states and also your cars and truck is worth $10,000 and fixings are estimated to set you back $7,500, your insurance coverage company would certainly proclaim it an overall loss.

If it pertains to planning for the future, leaving debt, or perhaps traveling the world on factors Find out more. Find out more.

What Constitutes a Complete Loss? When the expense to repair your cars and truck surpasses its actual worth, your insurance policy provider will certainly figure out that your car is a complete loss - cars. Depending upon the seriousness of the damage, you might currently understand that your car was mosting likely to be regarded a complete loss.

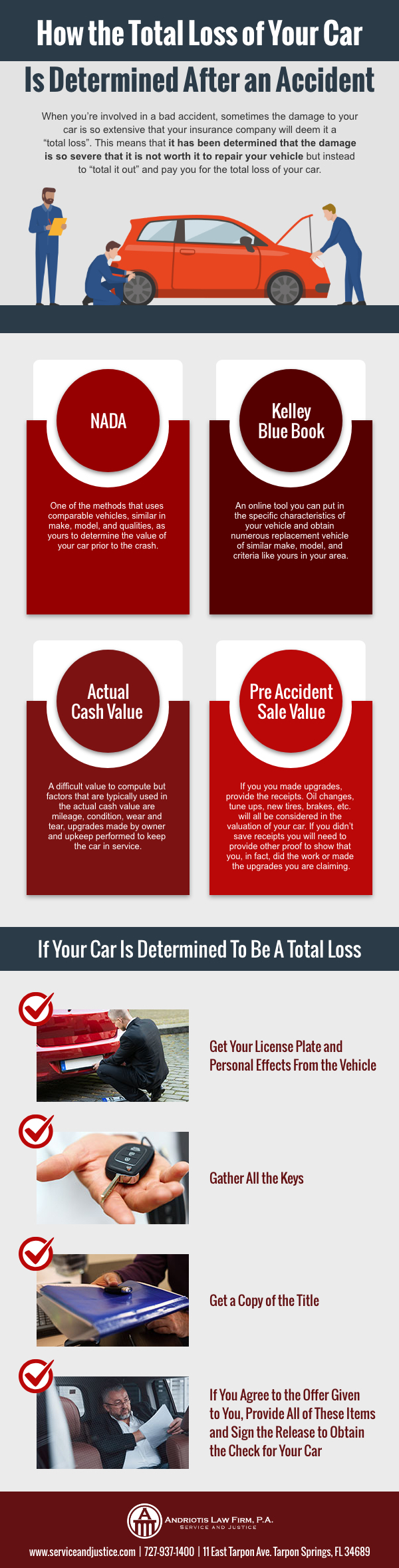

Just How Does Insurance Policy Determine Your Auto's Worth? Every car on the road has what is called a "reasonable market value." The worth of your cars and truck is generally identified by factors such as year, make, model and mileage (cheapest car insurance). Your insurance policy provider will think about the value factors and will make you an offer based on the decision of your automobile's actual cash worth.

In a current post I started speaking about a few of the issues that turn up when your cars and truck is damaged in a vehicle wreck. The one problem I did not get to is when the insurance policy business informs you that your lorry is amounted to or a total loss.

The 5-Minute Rule for My Car Was Just Totaled. What Do I Do? - Capital One

For that reason, in my example, you can recover the $7,000 the Explorer deserved with some fees for tax obligations and titling the car. The truth that it may cost you more money to change that lorry with something just as good, is irrelevant in the eyes of the legislation. cheapest car. Yes, you can maintain your automobile if an accident totals your auto.

The insurance coverage company will subtract whatever money they would have obtained from a junkyard for the Traveler. This is generally referred to as salvage worth and also it often tends to run about 20% of the fair market price of the lorry. In the situation of the Traveler, you might keep it yet the insurance policy company would certainly pay you around $5,600 instead and you would have to apply to your neighborhood Region Clerk for a salvage title.

It depends. When you inform the various other party's insurance business of your claim, you need to inquire if you are entitled to repayment for a rental automobile or other replacement transport. While the insurance provider need to inform you how much they would allow for a rental car or various other transport, they do not need to commit to making any type of repayments up until it ends up being reasonably clear that their insurance holder was legally accountable for the accident - trucks.