If you don't have ridesharing insurance policy and you're in a mishap, you can be accountable for all the problems-your personal insurance coverage likely will not cover you. How University Trainees Can Obtain

A Discount On Discount Rate InsuranceVehicle Insurance Policy of the hardest parts about components concerning contrasting auto insurance policy choices the discounts that discount rates available to offered. low cost. Is Changing Cars And Truck Insurance Well Worth It?

Another point that can make changing vehicle insurance worth it is incorporating it with tenants insurance coverage. If you obtain an auto insurance coverage and also occupants insurance policy at.

cars suvs credit score credit score

cars suvs credit score credit score

the same companyVery same firm renters insurance tenants insurance policy free(cost-free you can view it watch a significant discount considerable price cut car insuranceAutomobileInsurance coverage Typical Cars And Truck Insurance Coverage In Ontario By Month, Age As Well As Gender Wondering how much your vehicle insurance coverage will cost in Ontario?

They tend to drive extra, are more most likely to be entailed in crashes, as well as participate in riskier driving behaviours. G1 drivers can not be noted as the main vehicle driver on a policy. A policy with a G1 driver provided will result in a rate rise.

Statistically, you are a higher hazard to entering into a collision or suing. To conserve cash, you can obtain detailed on a moms and dads or guardians intend as an occasional motorist. It will increase the premium, but not as much as if you secured a different plan.

No-fault states consist of: What Various other Elements Affect Car Insurance Coverage Rates? Your age and your residence state aren't the only points that affect your rates. Insurance companies utilize a variety of elements to figure out the expense of your premiums. Below are a few of the most crucial ones: If you have a clean driving document, The original source you'll find far better rates than if you've had any recent accidents or website traffic offenses like speeding tickets.

What Does How Much Is Car Insurance Per Month? Do?

Others offer usage-based insurance that might conserve you money. If your cars and truck is one that has a possibility of being taken, you may have to pay more for insurance policy.

In others, having poor credit scores might trigger the expense of your insurance coverage premiums to rise dramatically. Not every state allows insurers to make use of the gender detailed on your vehicle driver's certificate as a determining aspect in your premiums. Yet in ones that do, women motorists usually pay a little much less for insurance than male motorists (cheapest car insurance).

Why Do Cars And Truck Insurance Rates Adjustment? Looking at ordinary cars and truck insurance rates by age as well as state makes you question, what else influences prices?

An at-fault mishap can raise your rate as a lot as 50 percent over the following 3 years. In general, car insurance coverage often tends to obtain extra expensive as time goes on.

Luckily, there are a variety of various other discounts that you could be able to take advantage of right currently. Here are a few of them: Numerous business give you the greatest price cut for having an excellent driving background. Called packing, you can obtain lower prices for holding more than one insurance policy with the very same business.

Homeowner: If you possess a home, you might obtain a property owner discount rate from a variety of providers. Obtain a discount for sticking to the exact same company for multiple years. Here's a key: You can always contrast rates each term to see if you're obtaining the very best rate, despite your loyalty discount rate.

Top Guidelines Of How Auto Insurance Rates Have Changed Over The Past Decade

Nonetheless, some can also elevate your rates if it turns out you're not a great driver. Some business offer you a price cut for having a great credit rating. When looking for a quote, it's an excellent idea to call the insurer and also ask if there are any kind of more price cuts that put on you.

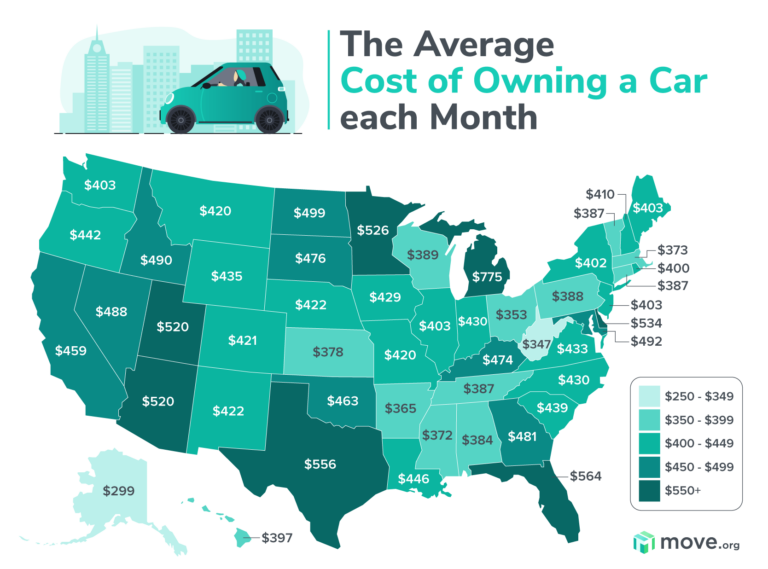

On average, the rate for a full-coverage policy can cost from $1300 in Maine to $8700 in Michigan. It can additionally vary within a state according to risk consider particular locations. If you live or store your car in a location that is regarded "high danger," whether it is because of regular accidents, criminal activity, or climate conditions, you might have a greater insurance rate than a driver with a comparable account in a various location - prices.

cars cars low cost cheap insurance

cars cars low cost cheap insurance

Minimum protection is the least pricey plan you can get for your cars and truck, but it only covers the minimum needs by regulation from the state. With complete coverage, you have detailed and accident insurance coverage along with the minimal insurance coverage. This option is much more expensive, it comes with more protection for your lorry.

Age is utilized to indicate just how much threat a driver is to the insurer. Young or inexperienced motorists are a higher threat for the insurance coverage business, which is why they have greater insurance premiums. When drivers are 30 or older, auto insurance policy premiums are affected by gender - affordable auto insurance. Youthful male motorists might have a costs that's 10 percent greater than that of a young women chauffeur.

In the states that allow gender-based rates, the distinction in costs in between males and also women is much less than 1 percent. The six-month typical car insurance policy premiums by gender are: Male: $734.

cheaper auto insurance cheap insurance risks liability

cheaper auto insurance cheap insurance risks liability

No-fault states include: What Various other Factors Influence Automobile Insurance Rates? Your age and your home state aren't the only things that influence your rates.

What Does Average Monthly Car Insurance Rates In Alberta - Brokerlink Mean?

Some insurance companies may use discounted rates if you don't utilize your car much. Others provide usage-based insurance that might conserve you money. Insurance companies factor the chance of a lorry being swiped or damaged as well as the cost of that vehicle into your costs. If your automobile is one that has a probability of being swiped, you might need to pay even more for insurance policy.

vehicle insurance affordable auto insurance cheapest car car

vehicle insurance affordable auto insurance cheapest car car

In others, having poor debt could cause the cost of your insurance policy premiums to rise significantly. Not every state allows insurance companies to use the gender listed on your chauffeur's license as an establishing consider your premiums. In ones that do, women vehicle drivers typically pay a little less for insurance than male drivers.

Plans that just satisfy state minimal coverage needs will be the least expensive - suvs. Extra coverage will set you back even more. Why Do Cars And Truck Insurance Coverage Prices Modification? Considering ordinary automobile insurance policy prices by age as well as state makes you ask yourself, what else impacts rates? The response is that automobile insurance coverage prices can alter for many reasons.

An at-fault crash can increase your rate as a lot as 50 percent over the following 3 years. Overall, cars and truck insurance has a tendency to obtain extra expensive as time goes on.

Thankfully, there are a number of various other price cuts that you could be able to take advantage of now. Here are a few of them: Lots of business offer you the most significant discount for having a great driving background. Called packing, you can obtain lower prices for holding even more than one insurance coverage policy with the very same business.

House owner: If you own a residence, you might get a property owner discount rate from a variety of providers. insurers. Obtain a price cut for sticking to the very same company for several years. Right here's a trick: You can constantly compare rates each term to see if you're getting the most effective cost, also with your commitment price cut.

The 6-Second Trick For Best Car Insurance Companies Of May 2022 – Forbes Advisor

Nevertheless, some can additionally raise your rates if it turns out you're not a great vehicle driver. Some business offer you a discount rate for having a great credit history. car insured. When searching for a quote, it's a great idea to call the insurer and ask if there are any type of even more discount rates that put on you.

On average, the cost for a full-coverage policy can set you back from $1300 in Maine to $8700 in Michigan. It can additionally vary within a state according to take the chance of consider particular places. If you live or store your car in a location that is deemed "high danger," whether it's due to constant crashes, crime, or climate condition, you might have a greater insurance coverage price than a vehicle driver with a similar account in a various place. vans.

Minimum insurance coverage is the least pricey policy you can obtain for your automobile, yet it only covers the minimal demands by legislation from the state. With full protection, you have thorough and crash coverage in addition to the minimum protection - auto. Though this alternative is much more expensive, it comes with even more security for your automobile.

Age is used to suggest exactly how much threat a vehicle driver is to the insurance provider. Young or inexperienced chauffeurs are a greater risk for the insurance provider, which is why they have higher insurance premiums. Once motorists are 30 or older, vehicle insurance policy costs are influenced by sex. Young male chauffeurs might have a premium that's 10 percent more than that of a young women vehicle driver.

vehicle insurance cheap car auto insurance cars

vehicle insurance cheap car auto insurance cars

Some areas in Michigan likewise have a restriction on gender-based prices. In the states that permit gender-based rates, the distinction in premiums in between guys and also women is less than 1 percent. The six-month average car insurance policy costs by gender are: Man: $734. 90Female: $739. 94As you can see, the difference in premiums in between man and grown-up women chauffeurs is minimal, though gender does have an influence on premiums for young chauffeurs.